Credit Repair • Coaching • Funding Prep

Take Your Credit to the Next Level

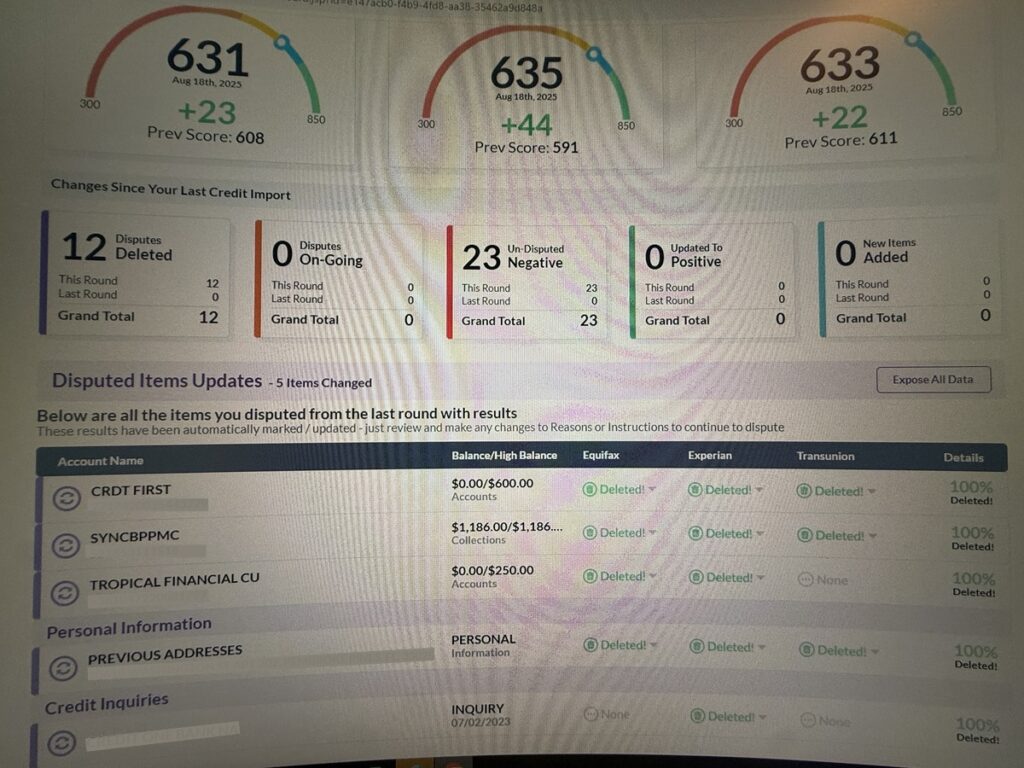

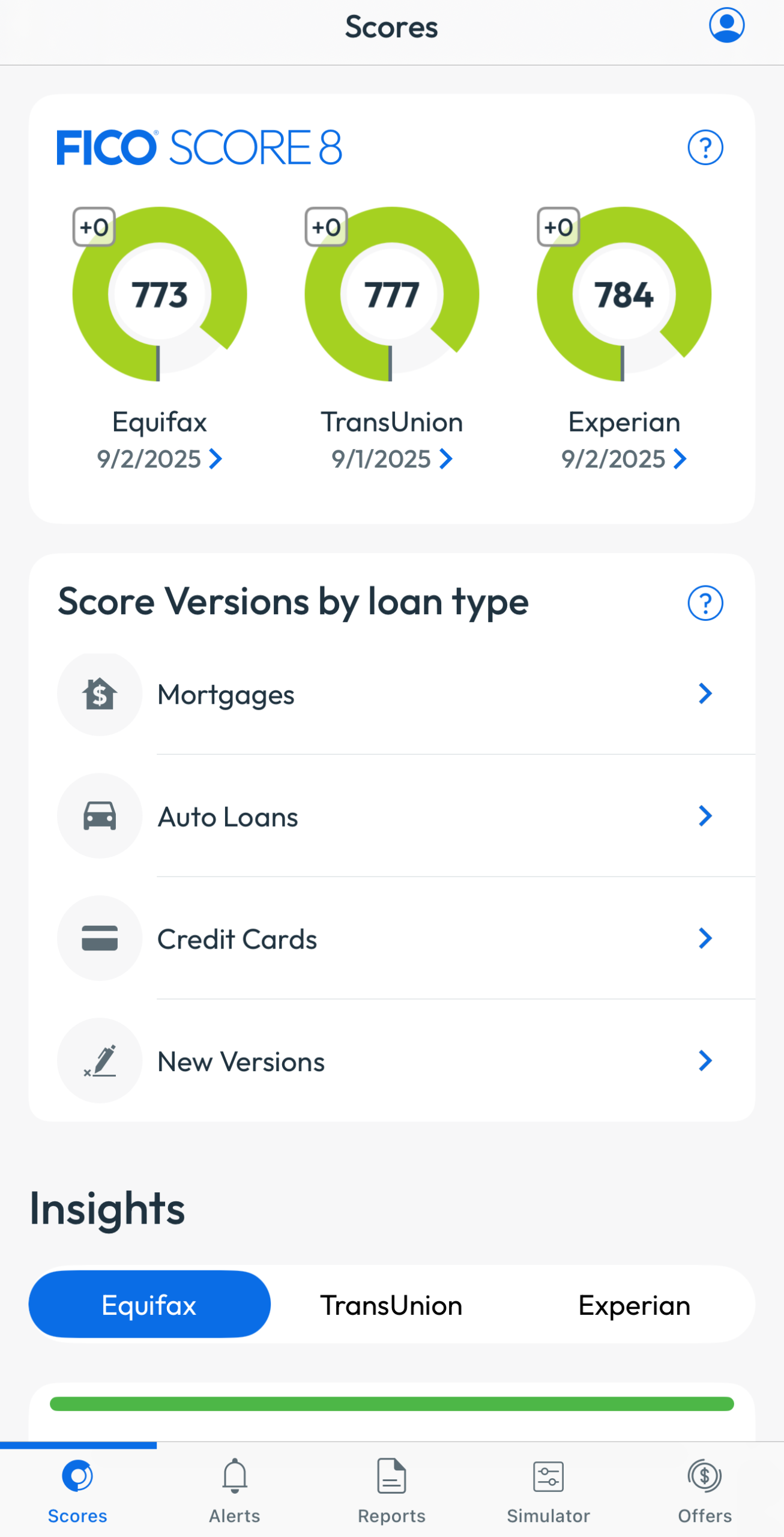

Valerus Enterprises helps you strengthen your credit, remove inaccurate negative items, and build a financial profile ready for real approvals. Our program blends expert dispute work with coaching, funding preparation, and ongoing support so you can move from credit struggles to true financial leverage. Start your journey with a free consultation.

Why CHOOSE US?

At Valerus Enterprises, we make credit repair simple, personal, and effective.

Expert Care

Your credit is analyzed across all three bureaus and receives custom dispute work tailored to your unique situation.

Smart Coaching

We guide you through rebuilding your credit, strengthening your profile, and preparing for funding opportunities.

Real Tracking

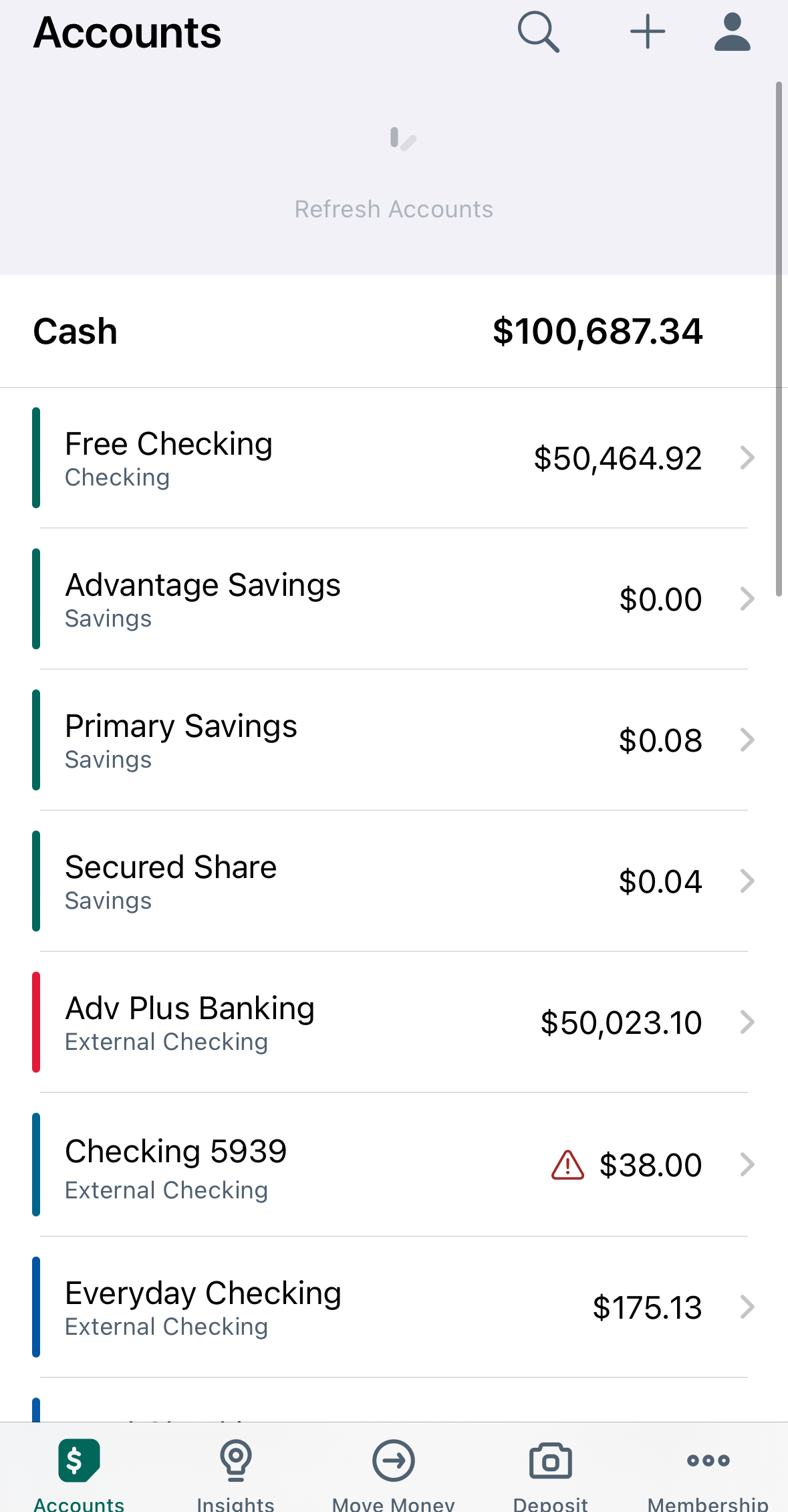

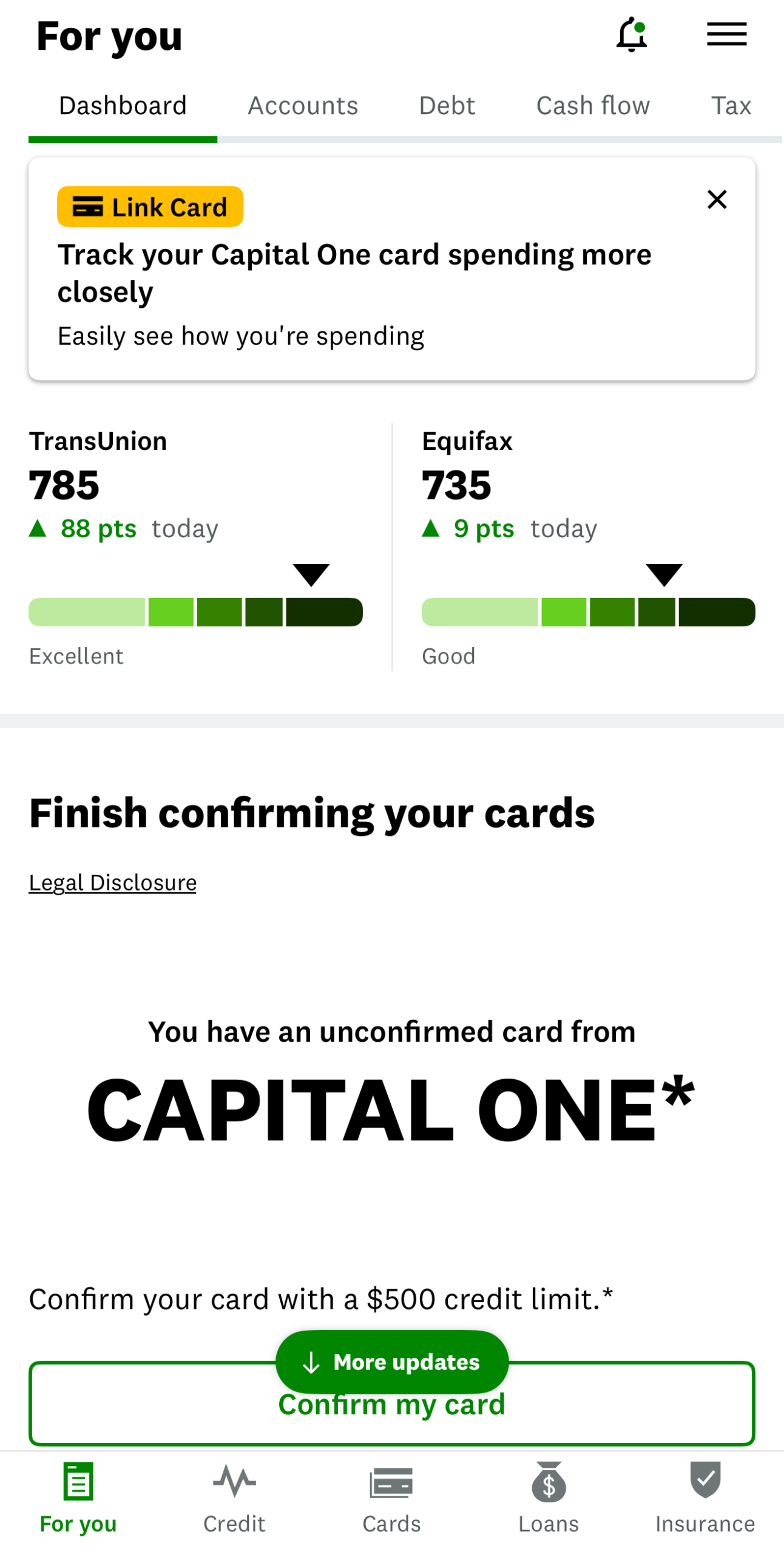

You get access to our app and client portal where you can monitor dispute progress and upload updates.

Building Stronger Credit Futures...

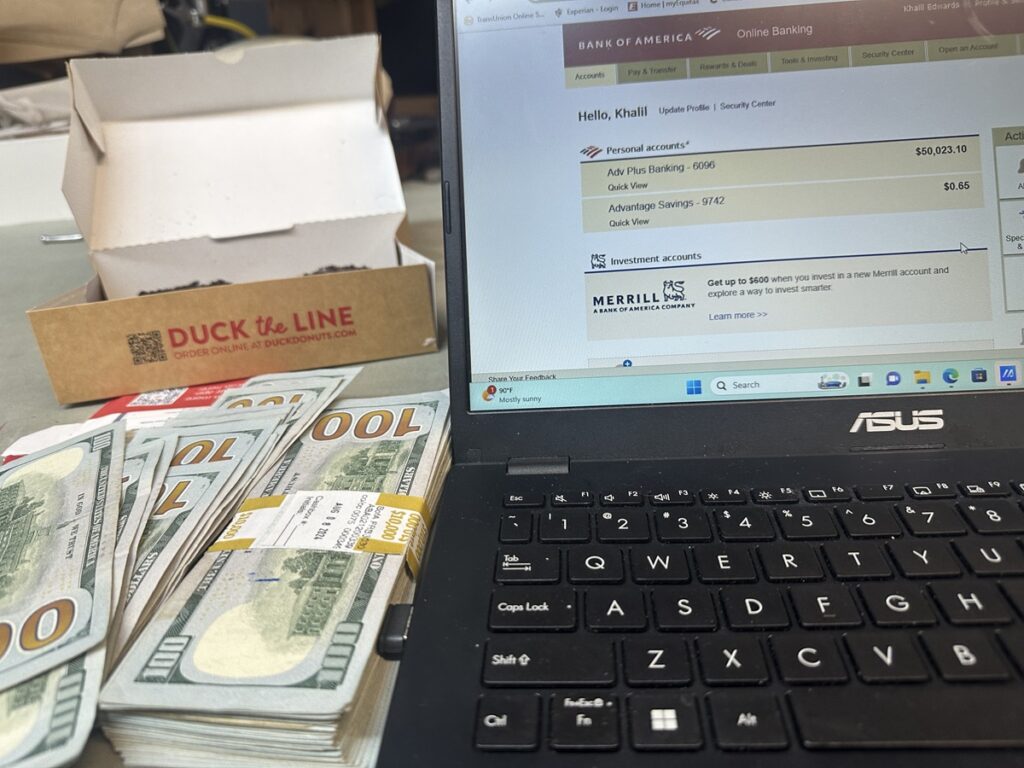

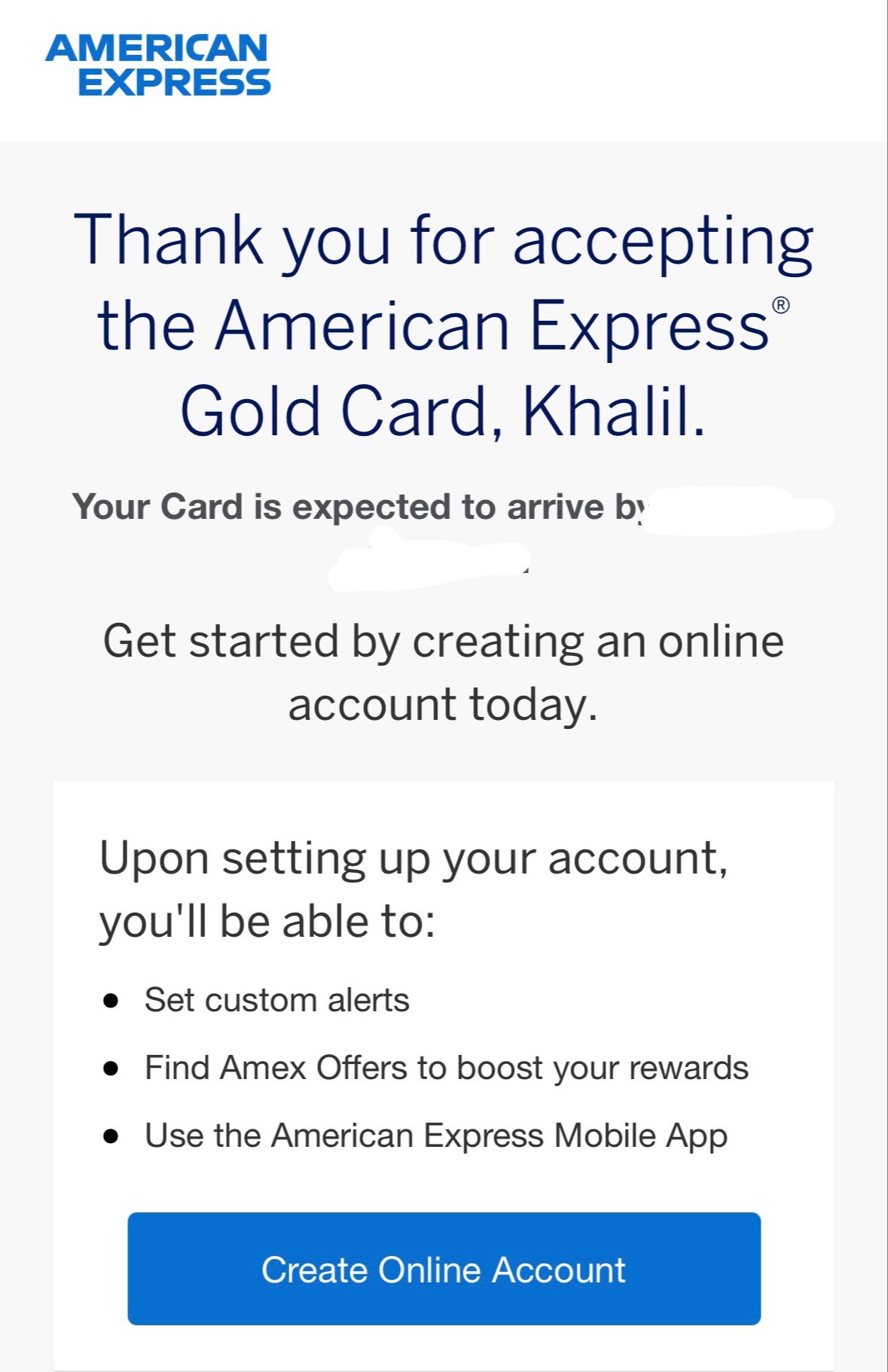

Valerus is led by Khalil, a credit specialist dedicated to guiding clients with expertise and integrity. His approach focuses on rebuilding credit with intention, teaching the right habits, and preparing each client for meaningful financial opportunities. Khalil believes credit repair should not stop at removing negative items. It should empower people to take control of their financial future with confidence.

Valerus Enterprises is committed to transforming the credit journey for individuals who want real financial progress. Through our NextLevel Credit Repair program, we combine customized dispute strategies, personalized coaching, and funding preparation to help clients clean their reports and strengthen their financial profiles.

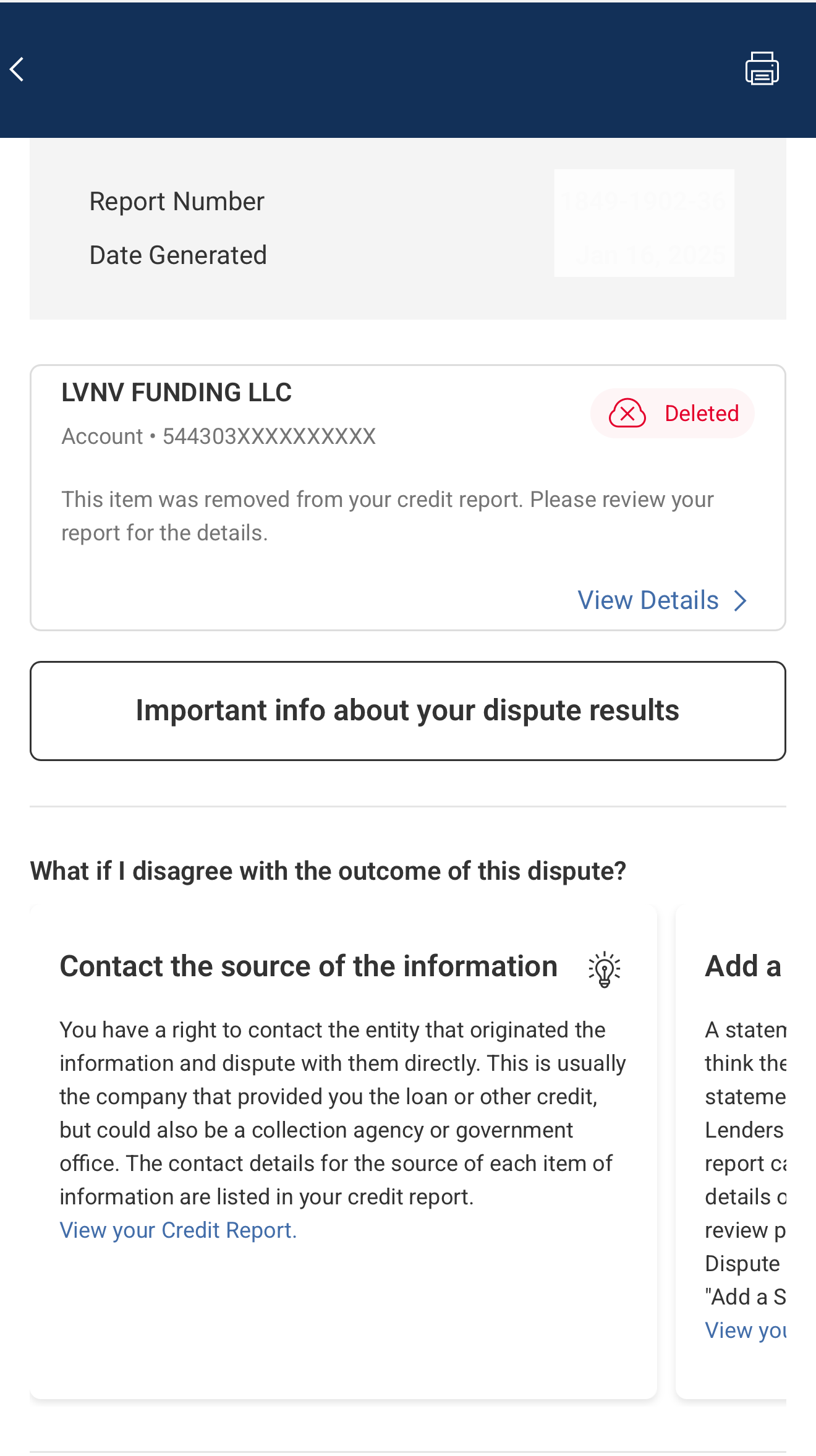

Items We Remove

We challenge inaccurate, outdated, or unverifiable items that may be holding your score down.

Federal demands

Reviewed and disputed to correct inaccurate or outdated payment reporting.

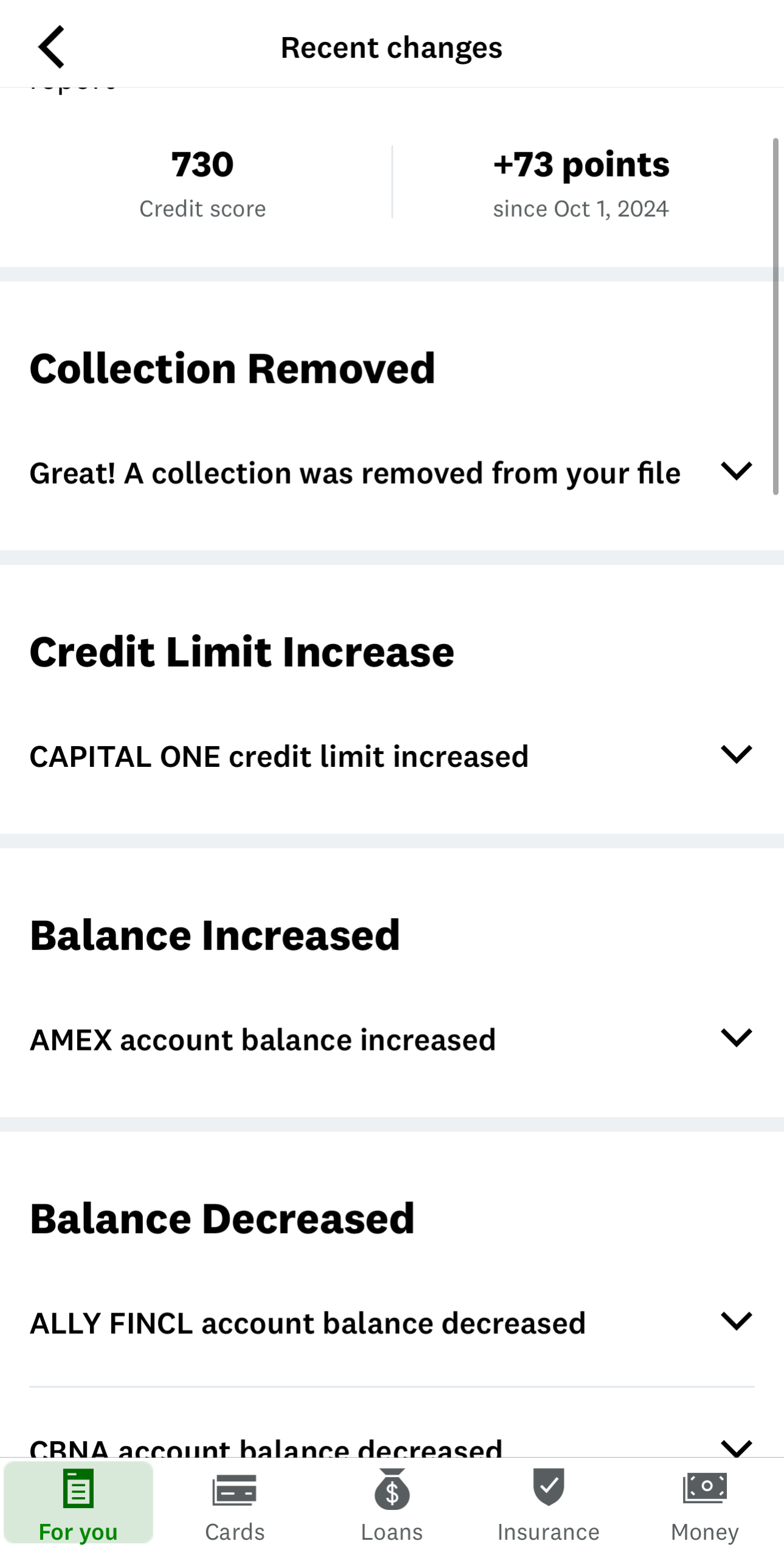

Collections

Analyzed and challenged to address invalid or improperly listed collection accounts.

Charge Offs

Reviewed and disputed to fix errors impacting your charged off accounts.

Repossessions

Analyzed and challenged to correct unverifiable repossession entries.

Evictions

Reviewed and disputed to address errors in reported rental or eviction records.

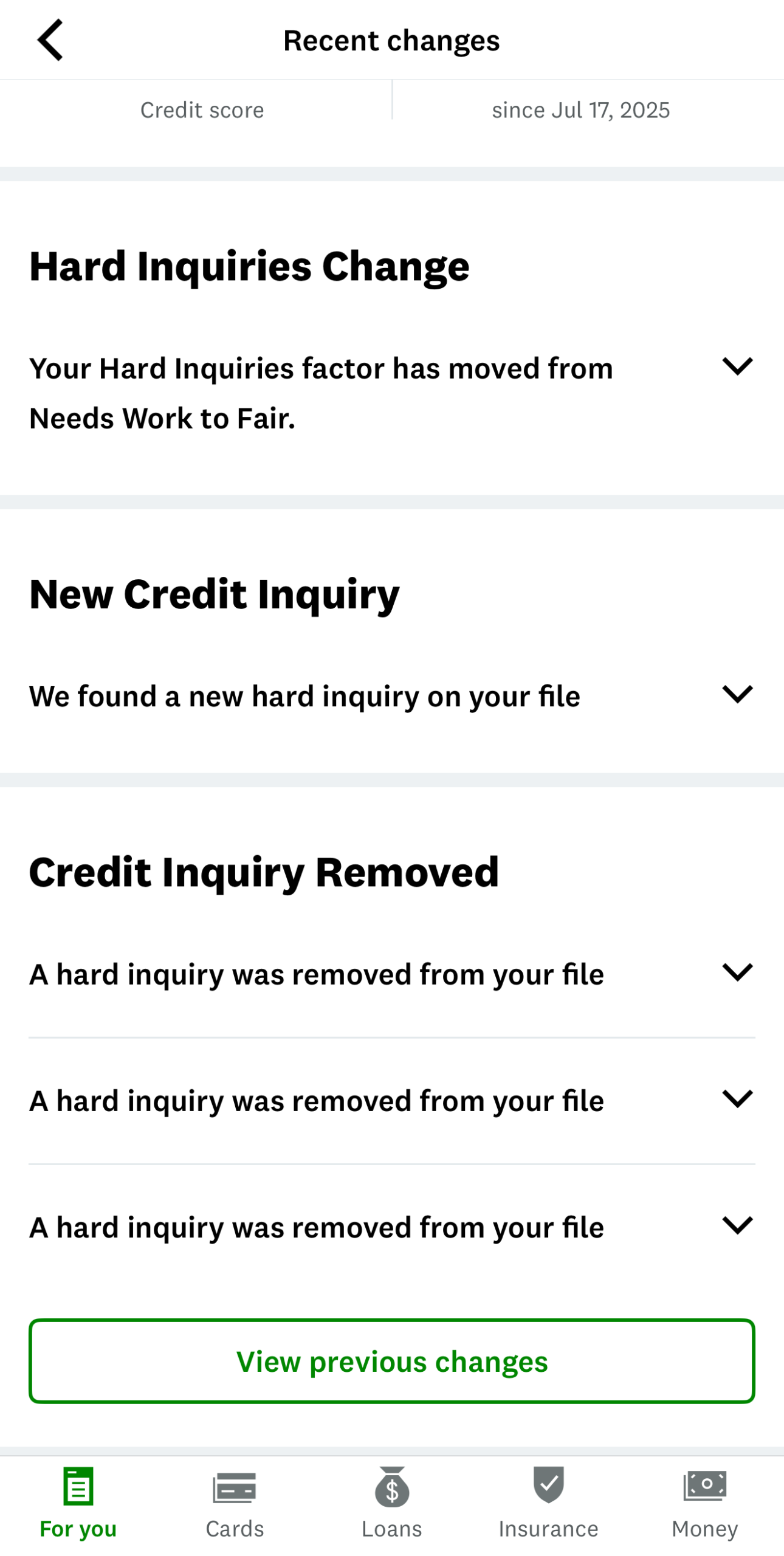

Hard Inquiries

Analyzed to remove unauthorized or inaccurately recorded inquiries.

Bankruptcies

Reviewed and disputed when reporting appears inconsistent or inaccurate.

Public Records

Analyzed and challenged to correct mistakes in court or legal record reporting.

Identity Errors

Reviewed and disputed to resolve mixed files, duplicates, or mistaken identities.

HOW IT WORKS

A simple guided process designed to help you move from assessment to results.

- Schedule your call and set up your three-bureau credit monitoring.

- Your details are entered into our system and payment is completed.

- Upload your documents and complete your online notary.

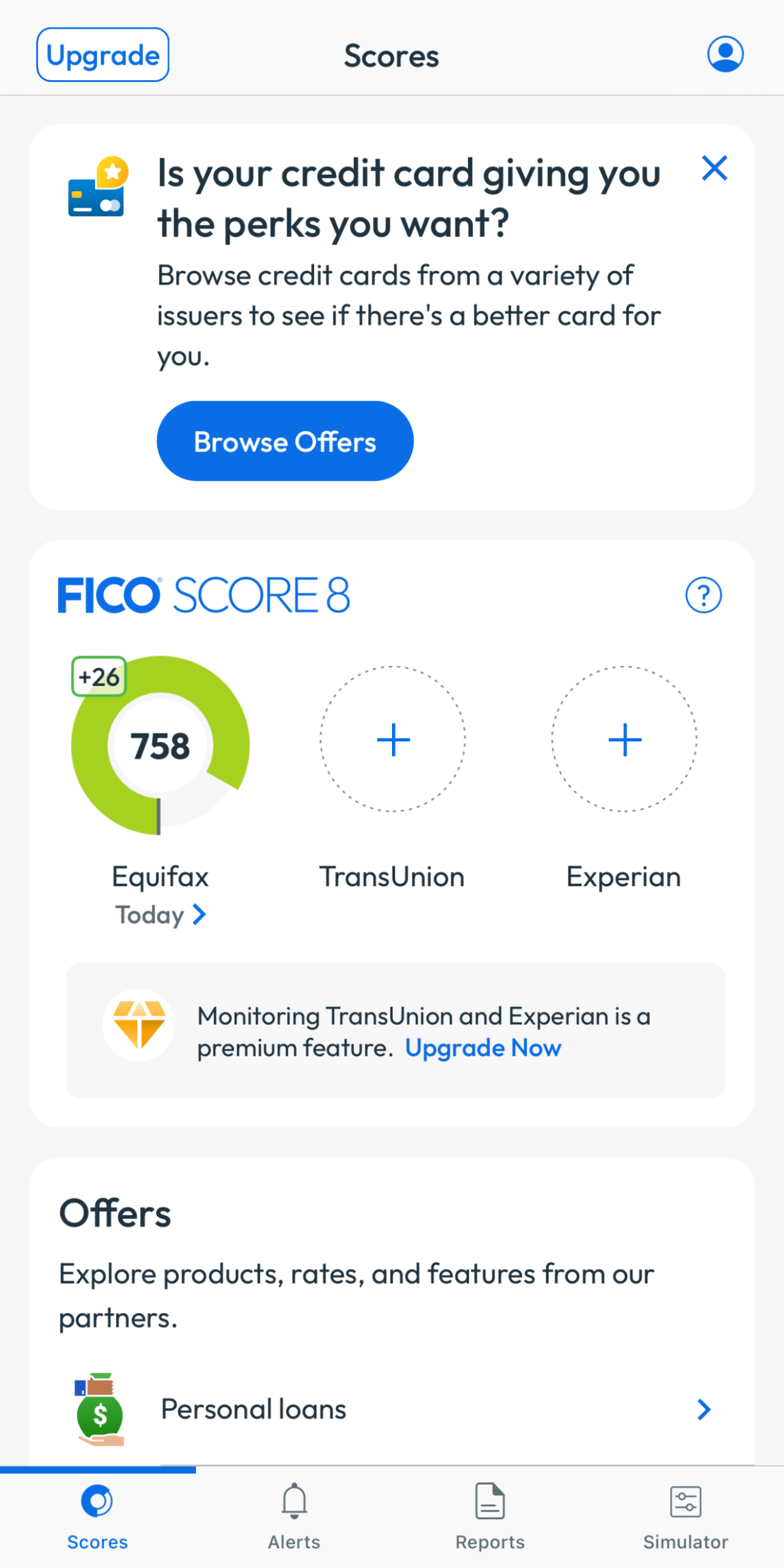

- Download the app and log in to track your credit progress.

- Receive personal coaching and guidance throughout your program.

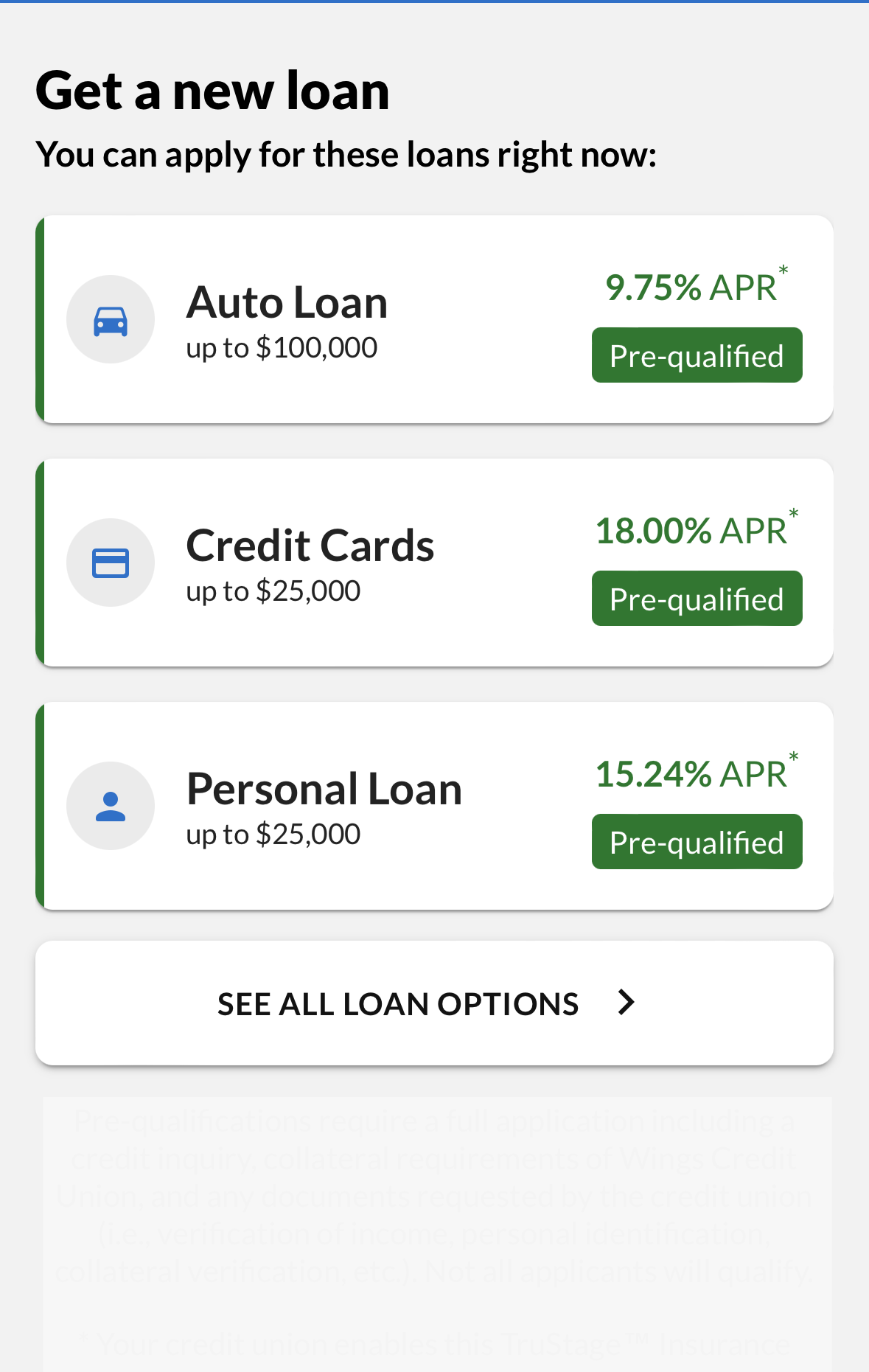

- As your profile improves you begin preparing for high-limit funding.

Features and Benefits

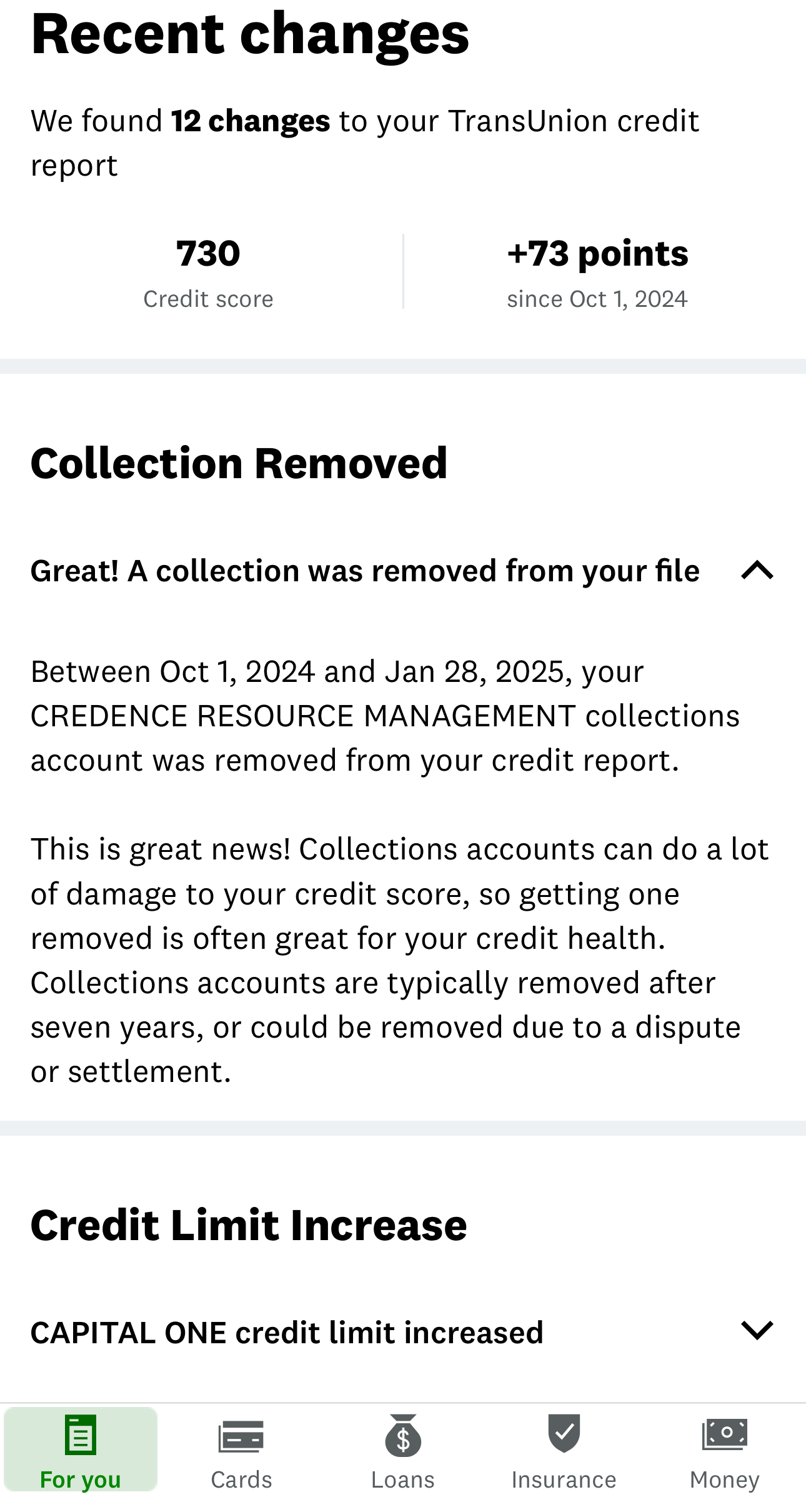

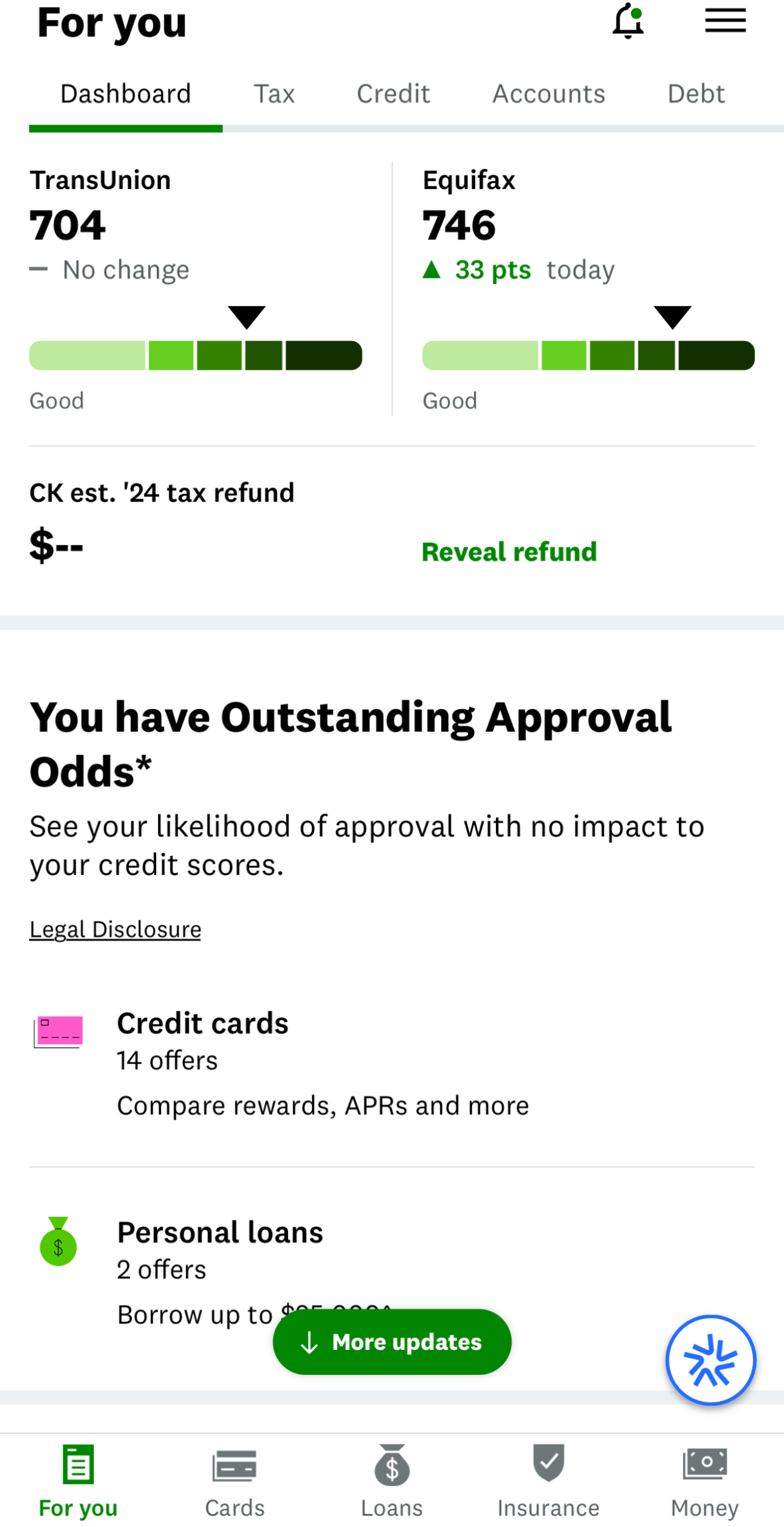

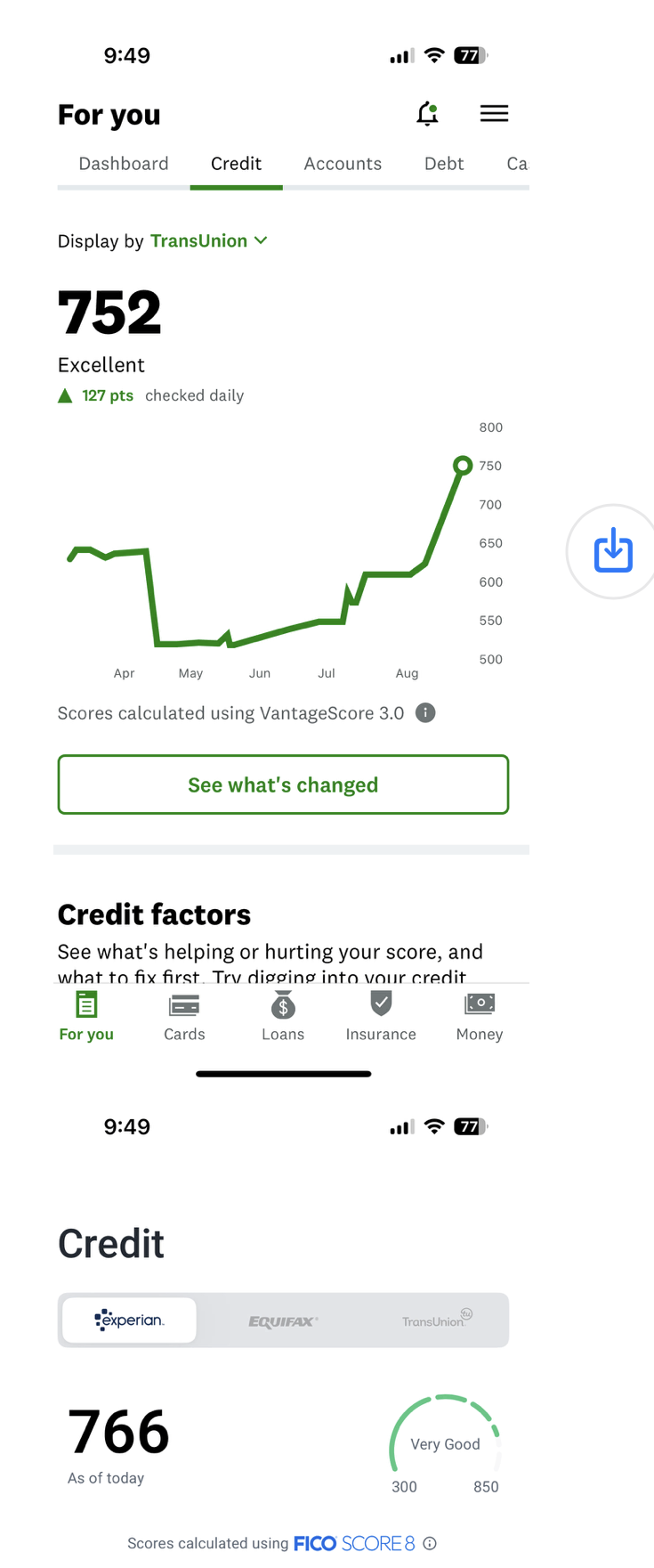

- Custom dispute work. We manually analyze your three bureau report and draft personalized legal disputes to remove inaccurate late payments, collections, charge offs, and inquiries.

- Coaching and credit strategy. We guide you on rebuilding, adding the right accounts, and preparing for approvals.

- Live progress tracking - Access our app to upload updates, receive notifications, and track your dispute results in real time.

- Credit monitoring setup - We help you enroll in proper three bureau monitoring which keeps us synced with your file for faster results.

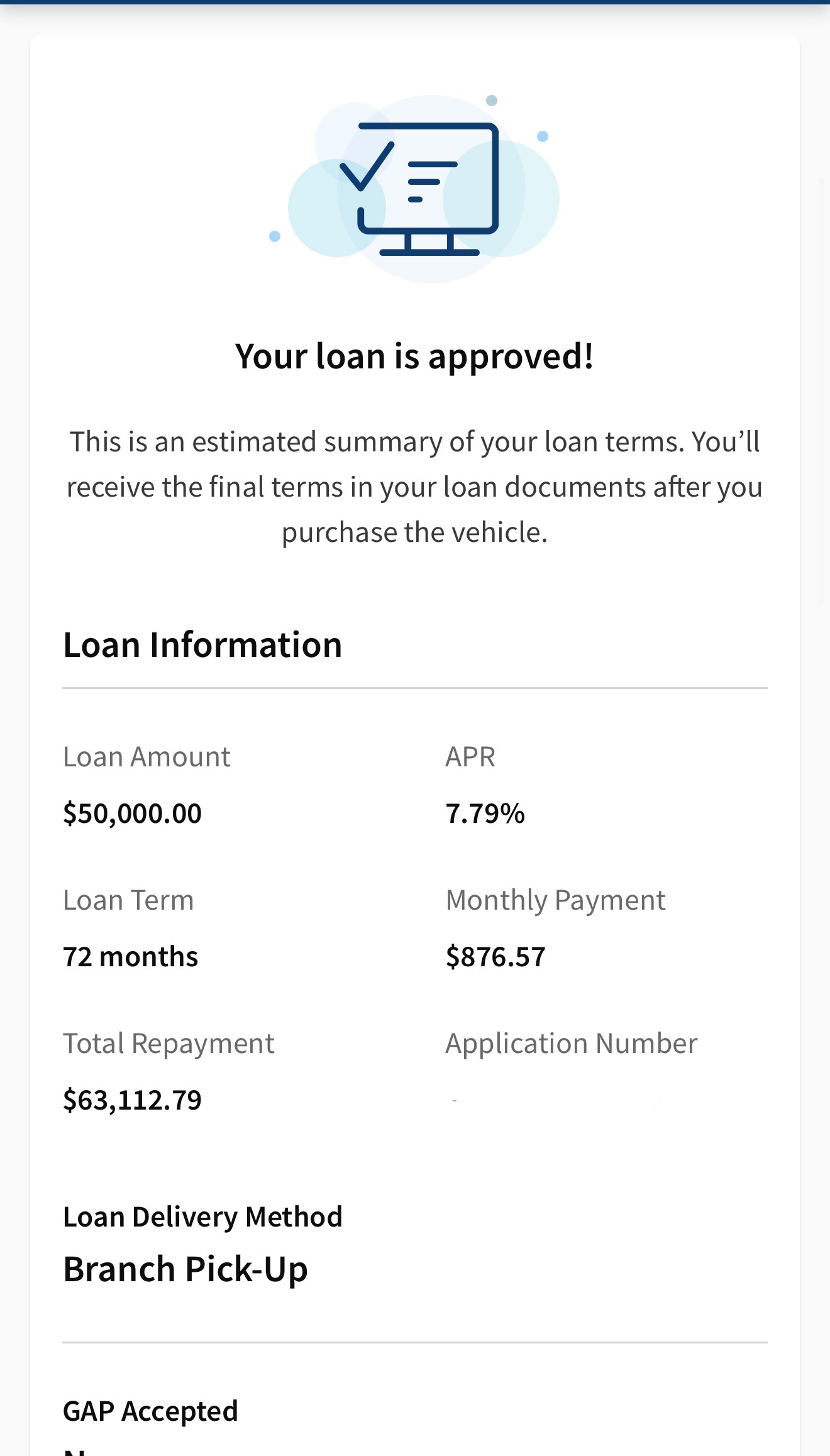

- Funding readiness path - Once your profile is ready we assist with high limit credit card and loan applications. Our clients do not just get clean reports. They get a roadmap to approvals and real financial leverage.

Personalized Credit Solutions

Every credit profile is different. Your strategy, timeline, and level of support depend on the items on your report and your financial goals. Schedule a consultation to receive a customized plan designed specifically for your situation.

Frequently asked questions (FAQ)

How long does credit repair take?

Every case is unique, but many clients begin seeing results within 30–90 days. The exact timeline depends on how many issues are on your report and how quickly creditors respond.

Do I need credit monitoring?

Yes. Three bureau credit monitoring is required so we can access your reports and track dispute results accurately.

Will disputing hurt my credit score?

No. Properly disputing inaccurate items does not lower your score and may help improve it.

Can you help me qualify for funding?

Yes. Our program includes funding preparation once your credit profile is ready for approvals.

What if negative items return?

We continue disputing with unlimited rounds and targeted strategies when necessary.

Is this service guaranteed?

No credit repair company can guarantee removals, but we use proven methods designed to deliver strong results.

Start building the profile you need for approvals, funding, and financial confidence. Our team is ready to guide you.

Home | About Us | Our Services | Contact | Free Consultation

Copyright © 2025 – All Rights Reserved | Valerus Enterprises